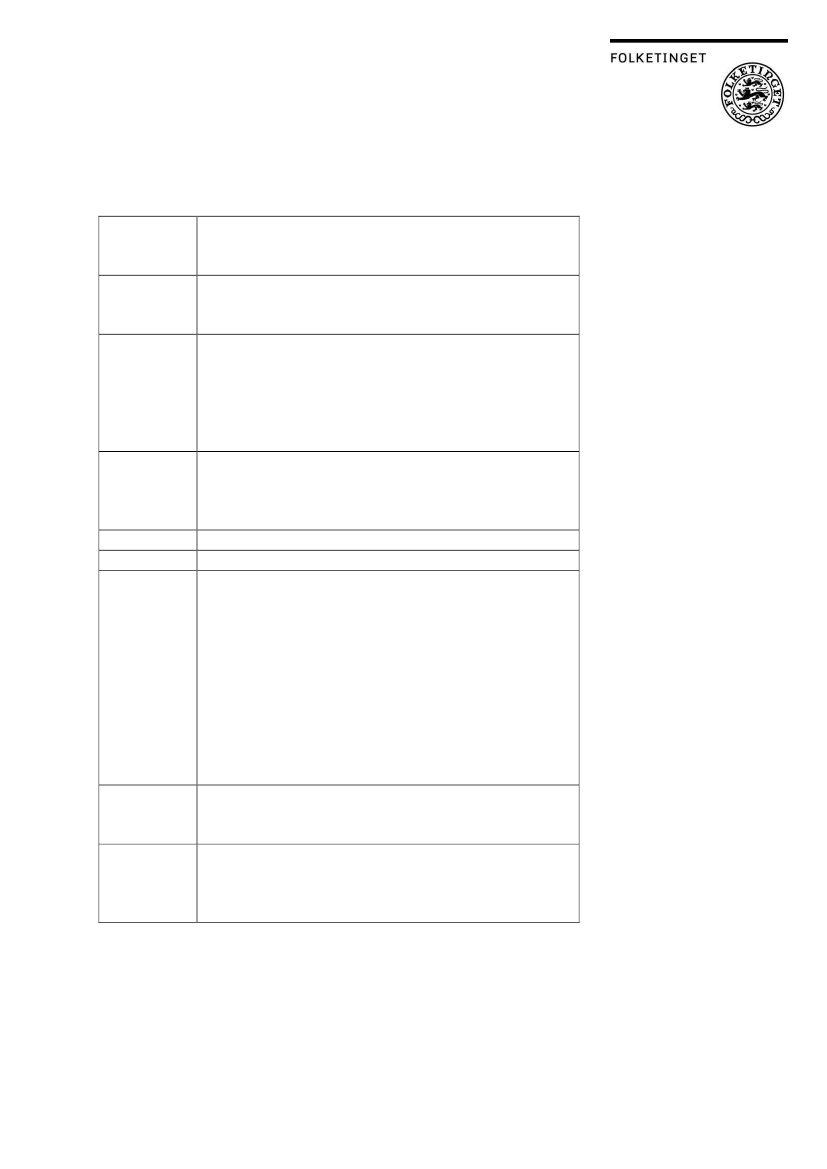

Programme, Public Hearing about

Paradise papers, tax havens and the digital economy

Thursday 11 January, 2018 at 10.30 am to 1 pm

Welcome and motivation

10.30-10.35

By the Chair of the Fiscal Affairs Committee

Peter Hummelgaard Thomsen

What are the Danish tax rules for multinational companies?

0.35-10.45

By Jakob Bundgaard, CEO, CORIT Advisory,

Honorary professor, Aarhus University.

How much do Denmark and the EU lose due to

10.45-10.00

multinational companies’ use

of tax havens? And how can

we organize the current tax system to minimize the loss?

By Mr. Ludvig Wier, PhD. at the Institute of

Economics at Copenhagen University, consultant

to the UN on questions regarding taxes

What initiatives are the European Commission working on

11.00-11.10

to ensure tax payments from multinational companies?

By Ms. Emer Traynor, Deputy Head of Unit

DG TAXUD, European Commission

Questions

11.10-11.30

Break (small sandwiches and fruit)

11.30-11.50

How does it become attractive to pay taxes in those

11.50-12.20

countries where activities take place and revenues are

generated?

By Jens Svolgaard, Vice President Tax, Spotify

How are funds operating to ensure the best possible return

on investments?

By Bo Foged, Executive Vice President ATP,

Group CFO - Chief Financial Officer and COO -

Chief Operating Officer, Pensions & Investments

12.20–12.55

Final general discussion including questions from the panel

and from the audience.

Closing remarks

By Louise Schack Elholm, Spokesperson on Fiscal

Affairs, the Liberal Party

Ref.: Anders Helmuth Knudsen

4. januar 2018

12.55-13.00

1/1