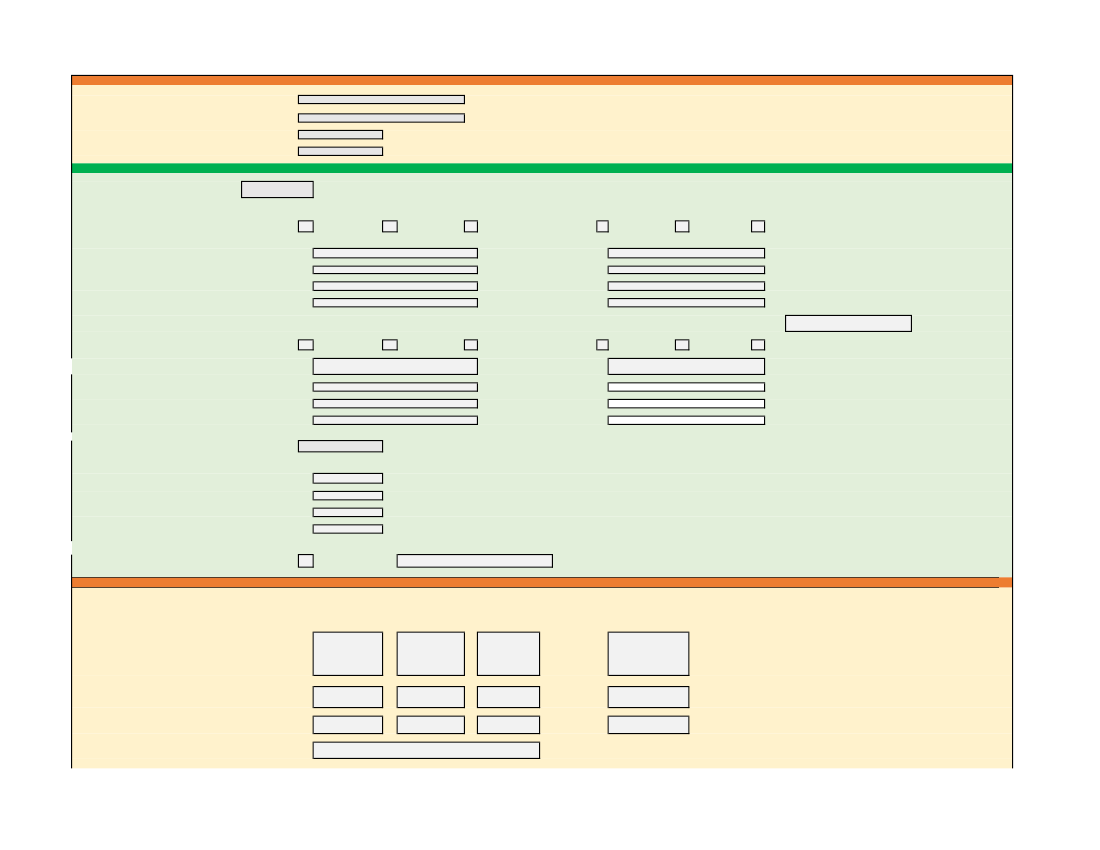

RESPONDENT INFO

Name of respondent (s):

Organisation

Member state:

Date of completion:

Danish Safety Technology Authority (DSTA), Ministry of Taxation

Denmark

Yes or No:

Q1a. Do you charge any fees for any products or procedures covered

by the TPD2?

Yes

DSTA: please see our answers to Q1b in questionnaire

Tobacco products except for novel products

(mainl Articles 5-6)

Q1b. If yes, please indicate

(mark with an X)

the procedures you

charge fees by the type of product:

Receiving product

reports/notifications

2019

(or cumulative)

2018

If you are unable to provide a breakdown by year, please provide

the cumulative figures. If you are unable to provide a breakdown by

product type, please provide the figures for the "Other" product type

2017

2016

Storing and handling

submitted information

1005000

1005000

1877000

335000

FEES

Novel tobacco products

(Article 19)

Analysis/verification of

submitted information

2019

(or cumulative)

2018

2017

2016

Receiving product

reports/notifications

Storing and handling

submitted information

Analysi

s/verifi

cation

of

Q1c. Please indicate the amount of fees (in Euros) collected by year.

e-cigarettes

(Article 20)

Receiving product

reports/notifications

DSTA: the amount of fee is for e-cigarettes, novel tobacco products

and herbal products

2019

(or cumulative)

2018

2017

2016

DSTA: please see our answers to Q2a in questionnaire

Q2a. Do you charge any fees to verify

measurements

(and methods)

for ingredients and/or emissions related to the implementation of

TPD2?

(Article 4)

Q2b. If yes to Q2a, how much (in Euros) have you collected for these

fees by year?

Yes or No:

Storing and handling

submitted information

684000

844000

1491000

819000

Analysis/verification of

submitted information

Costs related to other procedures, other products and/or that cannot be

broken down

(e.g. additives, ingredients, herbal)

- please describe:

Receiving product

Storing and handling

Analysi

reports/notifications

submitted information

s/verifi

cation

2019

(or cumulative)

2018

2017

2016

2019

2018

2017

2016

DSTA: please see our answers to Q3 in questionnaire

Q3. Do you charge any fees for peer reviews conducted on

additives?

(Article 6(4))

Yes or No:

If yes, please describe:

EU COMMON ENTRY GATE (CEG)

DSTA: we have only registered have many people were dedicated to our work concerning market

surveilliance for tobacco products and e-cigaret products overall.

Tobacco products: 4.9 people / 2019

E-cigarettes: 6.3 people / 2019

Q4a. On average, about how many people (full-time equivalents) are

Receiving product

dedicated to reviewing submissions to the EU-CEG?

reports/notifications

Costs related to other procedures, other products and/or that cannot be broken

down (e.g. additives, ingredients, herbal) - or cumulative

Tobacco products except

for novel products

(Articles 5-6)

Novel tobacco products

(Article 19)

e-cigarettes

(Article 20)

Please use 2019 as your reference ear. If you are unable to provide a

breakdown by product type, please provide the cumulative

estimates in the last column.

Storing and handling

submitted information

Analysis/verification of

submitted information

Q5b. What factors contribute to its variation per one submission?

(e.g. type of product)