Template for comments on draft ESRS Delegated Act

The draft delegated on European Sustainability Reporting Standards (ESRS) comprises: the main text of the legal act; twelve draft standards

(annex I); and a glossary of abbreviations and defined terms (annex II).

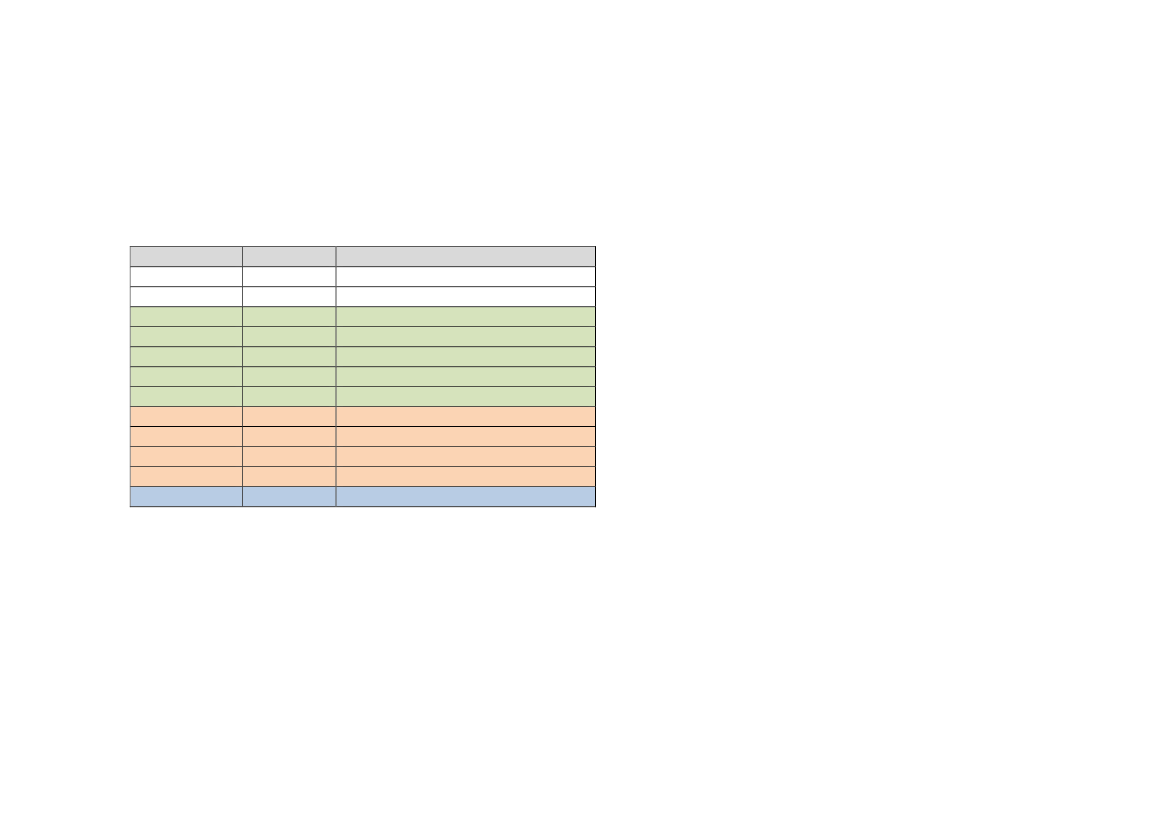

The twelve draft standards in Annex I are:

Group

Cross-cutting

Cross-cutting

Environment

Environment

Environment

Environment

Environment

Social

Social

Social

Social

Governance

Number

ESRS1

ESRS2

ESRS E1

ESRS E2

ESRS E3

ESRS E4

ESRS E5

ESRS S1

ESRS S2

ESRS S3

ESRS S4

ESRS G1

Subject

General Requirements

General Disclosures

Climate

Pollution

Water and marine resources

Biodiversity and ecosystems

Resource use and circular economy

Own workforce

Workers in the value chain

Affected communities

Consumers and end users

Business conduct

Each standard is divided into numbered paragraphs. Each standard

also has an appendix A containing “application requirements” which are

numbered as AR 1, AR 2 etc. Some standards also contain additional appendices.

To facilitate analysis of comments, respondents are kindly requested to use the simple template below when sending their comments.